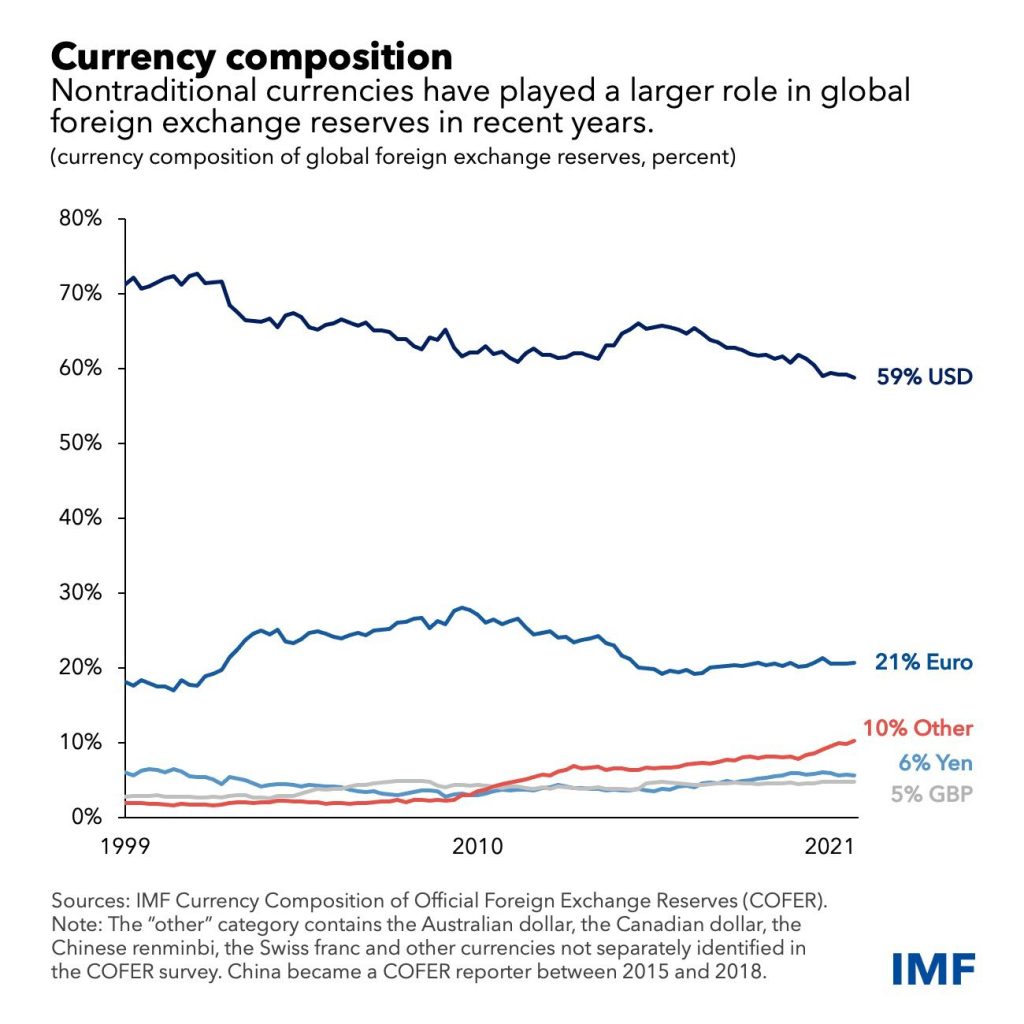

After World War 2, the dollar’s status as the world’s leading reserve currency has been unquestioned. In 2023, it accounted for approximately 59% of global reserves. However, its pivotal role as the backbone of international trade and finance has undoubtedly given the US unfair advantages in global markets that many countries wish to have a part in. In this essay, I will be evaluating alternative reserve currencies and their likelihood of displacing the dollar’s entrenched position.

Seigniorage is one way in which the US reaps the benefit of its dollar dominance. As the Federal Reserve of the US government issues currency, they profit from the difference between the cost of production for physical dollars and their face value. In 2005, foreign residents contributed $18 billion to the Treasury from demand for US currency, essentially generating interest free loans to the US government. Furthermore, global demand for dollar-denominated securities enables the US government to issue bonds at lower yields. This ‘exorbitant privilege’ enables the US to run greater fiscal deficits and find financing for its debt more easily, with less fears of high interest payments. The USA’s potent geopolitical leverage is further accentuated by the enhanced reach of economic sanctions and unilaterally influencing global trade flows.

However, the acceleration of de-dollarisation may be imminent. Many countries wish to escape the influence and shadow of the dollar. The punitive power of the dollar displayed by freezing Russia’s currency reserves has also motivated countries to look to other currencies to avoid dependency on the dollar. While the dollar’s share of global reserves has fallen from 70% in 2001, interest has been spurred in diversifying away from the dollar through alternatives such as the euro (which held around 20% of reserves in 2023), the Chinese renminbi, the Japanese yen and the British pound. Promoting competition in reserve currencies could share the benefits enjoyed by the US to other countries, bettering international relations between nations. Another proposition is the enhancement of the role of Special Drawing Rights (SDRs) created by the International Monetary Fund, a basket of major currencies, a diversified reserve asset that could reduce reliance on a single currency. With the potential to create a stable economic buffer, SDRs could mitigate the economic imbalances of the dollar’s stronghold on the international currency reserves,

Triffin’s Dilemma also stipulates disadvantages for the US for issuing the main reserve currency.

Higher exchange rates due to the dollar’s popularity for transactions cause a trade deficit for the currency issuing country, affecting the competitiveness of US domestic exporting industries. Diversifying away from a single major reserve currency could reduce fears of the potential for inflation from injecting large amounts of money into circulation, as concerns of shortages of liquidity globally are erased. However, in 2021, 60% of global trade was denominated in dollars, sufficiently large enough to absorb a short-run excess supply, diminishing apprehension of inflation, which the benefits of exorbitant privilege outweighs.

Despite the growing interest in alternatives, the dollar is likely to retain its position as the primary reserve currency. Significant barriers to other bodies to emulate the US economy’s stability, such as the eurozone’s fragmented fiscal policies and China’s regulatory controls over the renminbi limiting its convertibility obstruct the ability for their currencies to displace the dollar. Furthermore, the difficulty of coordinating substantial institutional changes to implement SDRs more widely in global reserves and the requirement of greater cooperation of IMF member countries significantly hinders their viability to displace the dollar. For the foreseeable future, the dollar’s place as the primary reserve currency is secure.

Leave a Reply